ELLICOTT CITY - Gov. Martin O'Malley called for a 20 percent rise in the sales tax and a 3-cent rollback in the state property tax rate last Thursday, September 20, the latest piece of a package aimed at erasing the state's $1.7 billion deficit.

O'Malley's plan to increase the sales tax from 5 cents to 6 cents per dollar would raise $730 million, while cutting the property tax from its current rate of 11.2 cents per $100 would save taxpayers $177 million, said state Budget Secretary Eloise Foster.

Thursday's announcement came a day after the governor proposed a more progressive income tax that he estimates will raise $163 million while still lowering the tax bill for 95 percent of taxpayers. He is expected to outline additional parts of his revenue package in the next week.

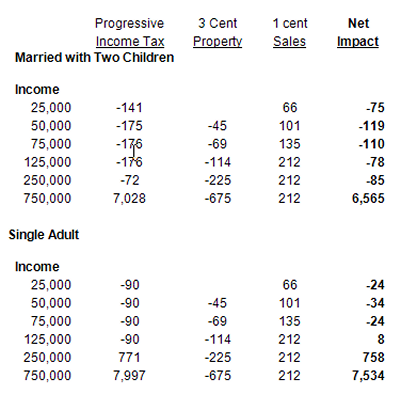

This table, which was prepared by the Governor's office, demonstrates how the various tax changes will affect people in different income brackets. The tax changes include a new progressive income tax schedule, a 3 cent property tax decrease, and 1 percent increase in the sales tax.

O'Malley is already facing skepticism, just two days into his series of announcements.

"I call it the 'O'Malley Traveling Magic Show,'" said Sen. Allan Kittleman, R-Howard. O'Malley is distracting taxpayers with one hand, Kittleman said, and using the other to pull "your wallet out of your pocket."

But O'Malley said that, even with a sales tax increase that would also apply to tanning salons, health clubs and property management firms, 83.5 percent of Maryland taxpayers will pay less under his plan.

Maryland's 5-cent sales tax is 42nd-lowest in the nation. The proposed 6 percent rate would bring the state in line with West Virginia and Pennsylvania and slightly above Washington, D.C. (5.75 percent) and Virginia (5 percent). Unlike Virginia, Maryland also exempts food and drugs from the sales tax.

But advocates on both sides of the tax issue are wary of the sales tax hike, agreeing that it would disproportionately affect those in lower-income brackets.

A "20 percent increase takes up a lot more of a working-class family's income" than it does for a more affluent family, said Robert O.C. Worcester, president of Maryland Business for Responsive Government.

Nick Johnson of the Center for Budget and Policy Priorities, which studies the impact of fiscal policy on low-income families, agreed but said the state may have to raise sales taxes "to close a revenue gap of this size."

O'Malley conceded that a sales tax increase is not ideal, but added that cuts in the property and income taxes will mean most low-income residents pay less in taxes. The property tax rollback will affect 1.45 million homeowners, the governor said.

But Worcester was skeptical.

"If you go buy an automobile, even a used one," the sales tax will "eat into" a lot of any property and income tax savings, he said.

Johnson commended O'Malley for including earned-income tax credits in his package, saying that would be the "biggest help" for low-income residents who are often exempt from income tax and rarely own real estate.

The governor reiterated his desire Thursday to call a special session this fall, saying "the only question remains" whether it can be called before early November.

But he may need to do more to sell his plan to both sides of the aisle before then.

Sen. Paul Pinsky, D-Prince George's, called O'Malley's initial proposals "an important first step," but added that "some other areas need to be addressed."

Pinsky said the state needs to do more to collect corporate taxes from companies that are incorporated in multiple states. And while he thinks it is "terrific" that O'Malley proposed a progressive income tax more and an earned-income tax credit, Pinsky said he was "still concerned that so much of the revenue package is based on sales tax."

Kittleman said Maryland has "a spending problem, not a revenue problem," noting that state revenues continue to increase "1 to 2 percent a year.

The Senate minority whip believes the state should simply limit its spending to the receipts it collects.

"If you can't afford your mortgage, don't build a garage," he said.