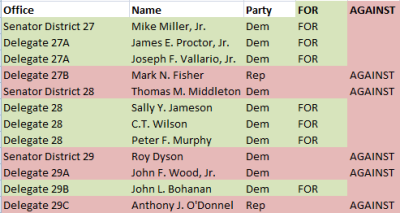

This chart shows how So. Maryland senators and delegates voted on 2013 HB1515. The final senate vote was 27-20, which in theory was margin enough to have allowed certain Democrats in conservative areas to switch their vote to remain "safe." (Data/caption compiled by somd.com staff)

ANNAPOLIS—Just 25 days after it was introduced, the Maryland Senate enacted the first gas tax hike in 21 years, sending the governor a 10 to 12 cent per gallon increase by 2015. The bill calls for the tax to go even higher — it will rise automatically in future years.

The senate vote on HB1515 was 27-20, with eight Democrats joining all 12 Republicans opposing what Senate Minority Leader E.J. Pipkin wanted to rename “The Gas Tax Job Killer Act of 2013.” (The House passed the bill by a vote of 76 to 63)

Instead the Democrats stuck with the title Transportation Infrastructure Investment Act of 2013, saying that the estimated $2 billion it would raise over the next five years will help bolster Maryland’s depleted Transportation Trust Fund. The money would be used to build and maintain roads and transit systems, including three new major transit lines, if federal money comes through.

Lockbox passes

The Senate also passed a constitutional amendment, SB829, that would require a three-fifths vote in both houses to use transportation revenue for programs other than roads and transit. If the House of Delegates passes this constitutional change introduced by Senate President Mike Miller,

voters will be asked to approve the creation of a long-proposed “lockbox” designed to stop raids on the transportation fund.

“This is our legacy,” said Sen. Richard Madaleno, the Montgomery County Democrat who was floor leader for both bills that were voted out of the Budget and Taxation Committee Thursday afternoon. Madaleno was among the few Democrats who spoke in support of the bill that had been put together by Gov. Martin O’Malley, House Speaker Michael Busch and Miller.

With passage of the bill, O’Malley said, “we will support more than 57,000 jobs, ease traffic congestion, and build a 21st century transportation network.”

The bill was the third time during his six years as chief executive that O’Malley sought to raise the gasoline tax.

“I want to congratulate the governor,” Pipkin said sarcastically. “He’s become the $3 billion governor” with 35 tax and fee increases since he took office.

All Republican amendments defeated

Republicans proposed a series of 15 different amendments to rein in aspects of the bill. One would have devoted all the new money to highways and another would have removed an inflationary clause tying future tax increases to the Consumer Price Index, a feature Pipkin called the worst aspect of the bill and Madaleno said was “innovative public policy.”

“We shouldn’t be putting taxes on cruise control,” Pipkin. “This is the most damaging to the poor.”

Reaction to the passage of the gas tax hike backed by major business groups and Democratic elected officials was predictable along ideological lines.

Reactions along ideological lines

“Maryland needs a first-class transportation network to attract jobs and remain competitive,” Howard County Executive Ken Ulman said in a statement.

“This is a major victory for everyone who is sick of traffic and a major boost for our economy,” according to a statement from the Suburban Maryland Transportation Alliance, which is chaired by former Montgomery County Executive Doug Duncan. The group mentioned road projects in Montgomery County that would move forward, although O’Malley has not made promises on specific highway projects.

“Approving an unaffordable 80% gas tax hike that will also increase the cost of food, clothing, and services, punishes Maryland families,” said Americans for Prosperity-Maryland Grassroots Director Nick Loffer. “Sending revenue, jobs, and Maryland citizens out of state with the 5th highest gas tax rate in the nation will lead to more pain in this difficult economy.”

Change Maryland Chairman Larry Hogan said, “They choreographed the proposal’s original announcement, committee hearings and final votes to take place on late Fridays and in the evenings to avoid news coverage in the waning days of this legislative session. This speaks volumes about just how unpopular more taxes are, and this may push Maryland to the tipping point. Taxpayers have finally had enough.”